Where do you sit on the trading sophistication spectrum?

Not all trading platforms are alike. There is a spectrum of levels of trading platform sophistication and complexity, which varies based on the ability to be at, or near, the top of the trading book, and so reduce slippage and generate profitable trading returns.

Traders will typically recognise where they sit currently on this spectrum - and perhaps may identify where they would prefer to be, or aim toward.

So what does the spectrum look like? And with which categories do OnixS SDK offerings align? Here, we consider various levels of trading sophistication, complexity and automation.

Please note that this is a generalised view of the spectrum, from low to high sophistication. We have not drilled in on any detailed consideration of asset classes or specific products/ instruments.

7 levels of sophistication, from low to high

- Click trading – public retail platforms. These are low, or zero-cost platforms that anyone / the public may access, and are based on manual buy/sell trading actions in a web browser or App.

- Retail scripted/bot trading. These provide the ability to automate some trades via rules/triggers within a retail platform.

- Professional click trading. Professional click trading uses trading apps/UI frameworks and platforms such as NinjaTrader or MetaTrader, with automated feeds to brokers, or trading platforms like InteractiveBrokers (IB) via FIX Protocol Standard APIs.

- Professional scripted trading. This can be considered a small step up from trading apps/UI frameworks, in that professional scripted trading includes the capability to automate trading rules using broker and trading platform APIs. This is where FIX Protocol standards provide significant value for indirect market access.

- Non-automated, institutional level click trading. These platforms support click trading UIs, but on complex products/instruments in a wholesale rather than in a retail market context. Common platforms here may include WebICE and CME Direct.

- Institutional level algorithmic trading. This is sophisticated automated trading using co-located blackbox trading engines running automated strategies with Direct Market Access (DMA). Drilling down into this general category of institutional level algorithmic trading, there is a further spectrum of sophistication. We see sophisticated quantitative methods using big data applications, alternative data sets, artificial intelligence, and machine learning to create and calibrate trading models.

- Optimised HFT algorithmic trading. This is the nanosecond trading context of Ultra Low Latency DMA (ULLDMA) where the target trades are latency critical, and the deployed trading engine uses go—faster optimisation tools such as custom hardware, overclocked machines, kernel bypass TCP stack, optimised NICs, Solarflare ultra-low latency ef_vi API, and Solarflare TCPDirect API. In the most extreme example, Application-Specific Integrated Circuit (ASIC) can be customised for a particular trade.

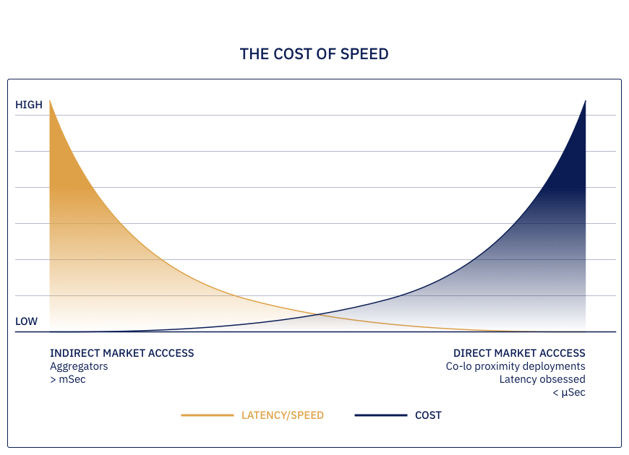

This sophistication spectrum correlates with the Cost vs Performance Curve.

Does it matter where on the spectrum a Trader sits?

At the lower end of the sophistication spectrum is low cost and high latency. That is low setup costs but your orders will not be fast to market. This may be fine where there is no latency criticality to the trading decisions.

Conversely, at the high end of the sophistication spectrum we see a high-cost trading infrastructure optimised for high performance automated trading where optimal order entry latencies are critical to the trading success.

Where do OnixS product offerings align?

OnixS SDK offerings are focused on the more sophisticated, higher level categories.

Here, we find that OnixS product offerings are most interesting to firms in the 3-7 categories on the trading sophistication spectrum. These firms are automating order entry APIs and/or post trade feed APIs and need to support the venue-specific session level protocols to integrate the application-level messaging into trading or post trade application frameworks.

Levels 3-4 (Professional click trading, Professional scripted trading)

At level 4 (and sometimes at level 3) we see usage of FIX Protocol Standards for standardised multilateral market data, order entry and post trade automation. Usage of FIX Engine implementations provide reliable, secure, session-level communication between trading counterparts with standardised application-level message usage specifications. FIX may not be suitable for all high latency critical contexts, but FIX usage does provide well-proven efficiency benefits for trading venues and market participants.

Level 5 (Non-automated, institutional level click trading)

At level 5, we see sophisticated products being traded manually with the emphasis being on highly automated post trade feed integration into Energy Trading Risk Management (ETRM), Risk and/or trade surveillance applications. These feeds are often based around FIX Protocol application-level messaging standards. The venue APIs are naturally directly associated with the order entry APIs in terms of trade and instrument types and are subject to the same venue version control/release trading updates.

Level 6 (Institutional level algorithmic trading)

At level 6, firms may choose to deploy "blackbox" off-the-shelf, closed source trading engine implementations where traders can tune the inputs to the trading engine with business level parameters. The downside of such systems is that the trade execution logic can be opaque, order entry latency for general use execution logic can be non-optimal, and the ability to customise a strategy to specific requirements can be limited. The upside is that such platforms can be excellent entry points for speed to market, successful for specific use-cases, and a good on-ramp to even more sophisticated tools.

Level 7 (Optimised HFT algorithmic trading)

And finally, at level 7 where we’re fighting for a speed advantage, the firm will develop a contextually specific trading framework, integrating the market data feed, order entry and post trade feed SDKs. The trading strategy will be optimised for a specific trade and be tightly linked to these SDKs. The complete trading engine will be deployed into colocation for physical proximity to the central order book, and instrumented for risk/limit management with remote command and control.

Find the FIX and DMA SDK offering for your level of sophistication

Ultimately, we see firms experimenting with FIX Standards and FIX Engines at level 4+ and licensing OnixS FIX Engine SDKs when they need highly performant supported FIX Engine SDKs.

Equally, we see many firms at level 5 looking to integrate post trade feeds using supported, calibrated SDKs that are kept updated with trading venue specific API changes.

And at levels 6 and 7, the OnixS Direct Market Access SDKs provide a suite of venue API specific SDKs for market data, order entry, and post trade APIs that are designed to integrate into automated trading strategy execution engines and trading application frameworks.

You can find out more about OnixS SDKs, and access a free evaluation SDK download distribution, specific to your target venue and code base here.